The start of a new tax year often brings a new set of financial legislation to wrap your head around, much of which could have a significant effect on the way you manage your wealth.

While some of the more significant changes announced in the Autumn Budget – such as including pensions as part of your estate for Inheritance Tax (IHT) purposes – won’t take effect for some time, several updates did come into force on 6 April 2025.

It’s essential to understand these changes, whether you’re:

- An individual managing your personal wealth

- A business owner managing employment costs

- An investor attempting to balance your portfolio

- Anyone wanting to keep up with regulatory changes that could affect you in the future.

With this in mind, continue reading to discover five of the most important financial changes you’ll see in the 2025/26 tax year.

1. Non-dom rules have shifted

For years, if you had a domicile outside the UK – often referred to as “non-dom status” – you could typically take advantage of a tax regime that limited your UK liability on foreign income and gains.

As of April 2025, the Government will replace this system with a residence-based approach.

Initially, the new Chancellor, Rachel Reeves, proposed a complete abolition of the non-dom regime, but following further discussion at the World Economic Forum in Davos in January 2025, she changed her stance somewhat.

Now, she will allow longer transition periods and reduce tax on overseas income for the next three years instead.

If you are a non-dom or have assets overseas, this change could have a considerable effect on your estate planning. You may even have to reassess how your global assets are structured, and it’s worth speaking to a professional today if this legislation affects you.

2. A rise in employer National Insurance contributions

If you’re a business owner, the changes to employers’ National Insurance contributions (NICs) are especially relevant to you.

From April 2025, the rate of employer NICs rose from 13.8% to 15%, which could result in a notable rise in payroll expenses.

Additionally, the threshold at which employers begin to pay NICs – known as the “secondary threshold” – was reduced from £9,100 to £5,000 a year.

As a business owner, this could mean that a larger portion of your payroll will now be subject to National Insurance, potentially affecting the profitability of your enterprise since this is often one of the most considerable costs for small and medium-sized businesses.

3. The Employment Allowance has increased

The Employment Allowance is essentially a relief that allows eligible businesses to reduce their annual NICs bill.

As of April 2025, this allowance increased from £5,000 a year to £10,500, offering potential tax relief to qualifying employers.

Another similar change is the removal of the previous eligibility cap, which previously prevented businesses with an annual NICs bill exceeding £100,000 from claiming the allowance.

Now that this restriction has been lifted, more businesses now have access to the relief, with Money Marketing revealing that 865,000 employers will pay no NICs this year.

This could provide some much-needed support in the face of rising employer NICs.

4. Scottish tax bands and thresholds changed

While the Autumn Budget did introduce significant changes to tax policy across the UK, Scotland’s Government also made considerable adjustments to the country’s Income Tax system.

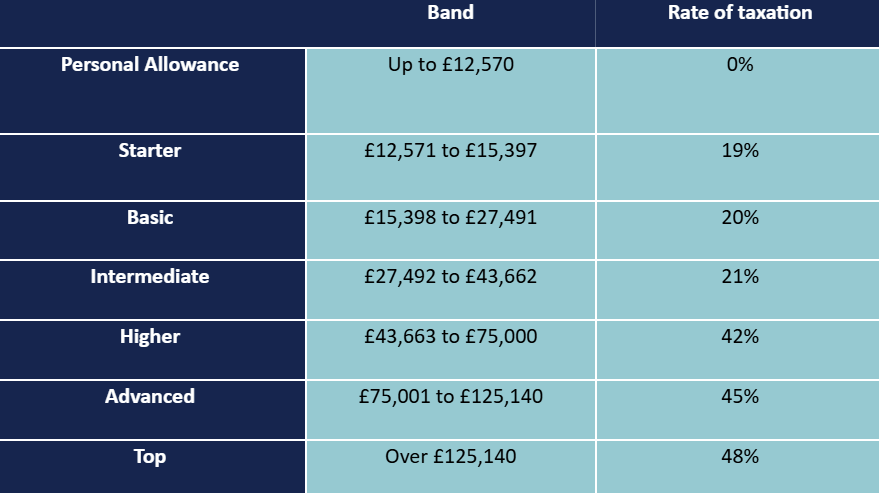

As such, the tax bands in Scotland have changes as follows:

It’s vital to remember that if your income exceeds £100,000, your Personal Allowance is gradually tapered by £1 for every £2 you earn over this figure. This could mean that, if you’re a higher earner, you may face an effective rate of tax above the stated figures.

If you live in Scotland, these changes might affect your take-home pay and tax liability, so it might be worth reviewing your tax strategies with your financial planner.

5. Capital Gains Tax changes

Capital Gains Tax (CGT) has also seen some notable adjustments, particularly regarding Business Asset Disposal Relief (BADR) and Investors’ Relief (IR) – previously known as “Entrepreneur’s Relief”.

In the Autumn Budget, the Government stated that while the lifetime limit for Business Asset Disposal Relief (BADR) will remain at £1 million, the lifetime limit for Investors’ Relief (IR) has fallen from £10 million to £1 million.

Meanwhile, the CGT rate on gains qualifying for BADR and IR rose from 10% to 14%, with a further increase to 18% occurring in April 2026.

This will benefit the state’s finances, with figures from the Government website predicting that this could raise an additional £1.44 billion in 2025/26.

However, if you’re planning to sell business assets, you may face a higher tax liability than in previous years, making it potentially beneficial to review your options with a financial planner to mitigate your exposure to CGT.

Get in touch

While it can often be challenging to stay abreast of financial legislation changes, we could help ensure that you and your wealth are up to date in the new tax year.

To find out how we can support you, please use our search function to find your nearest Verso office, email us at contact@versowm.com, or call 020 7380 3300.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.