You may well know that the latest Budget announcement on 30 October introduced new financial legislation and delivered a whole range of changes that could affect your wealth.

This was Labour’s first Budget in 14 years, delivered by the new chancellor, Rachel Reeves.

During the Budget, Reeves announced £40 billion in tax rises as she hoped to fill the “black hole” in public finances and rebuild services in the UK, the Guardian reveals.

Read more: Your Autumn Budget update – the key news from the Chancellor’s statement

Among the most significant changes was the announcement that pensions will no longer be exempt from Inheritance Tax (IHT).

Indeed, from 6 April 2027, unused pension funds and death benefits payable from a pension will be included in your estate for IHT purposes.

While this doesn’t come into effect until 2027, and government plans could shift between now and then, MoneyWeek reveals that the move could affect around 8% of estates each year.

There’s a chance this might change how you effectively manage your pension wealth and plan your estate in the future.

So, now that the dust has settled somewhat after the Budget, continue reading to discover why it’s so vital to plan ahead for these changes, and three ways you may be able to do so.

Your pension could mean you exceed the value of the Inheritance Tax thresholds

When pensions eventually become part of your estate for IHT purposes, effective estate planning will arguably be more important than ever.

Previously, pensions offered an IHT-efficient way to manage your finances. You could access other sources of wealth first to provide a retirement income, leaving your pension largely untouched so it could pass to your loved ones without incurring IHT.

However, when the announced changes come into effect, the value of your pension could push your estate closer to the IHT thresholds, increasing the potential tax burden for your beneficiaries.

The IHT “nil-rate bands” determine how much of your estate you can pass to your loved ones without them facing tax.

For the 2024/25 tax year, the nil-rate band stands at £325,000. Additionally, you can benefit from the “residence nil-rate band” of £175,000 provided you pass your main home on to a direct lineal descendant.

This combination could allow you to pass on up to £500,000 tax-free. Moreover, if you’re married or in a civil partnership, the unused portion of your nil-rate bands could transfer to your partner, meaning you could potentially leave up to £1 million to your loved ones free from IHT.

While these thresholds might seem generous, it’s far easier to exceed them than you might think.

Your home is likely one of your most valuable assets, and your pension – which is intended to fund your dream retirement – could significantly increase the size of your estate when included for IHT purposes.

3 ways to potentially reduce your Inheritance Tax liability

Fortunately, there are several strategies you can employ to reduce the potential IHT liability your family may face when they inherit your estate. Here are three points you may want to consider.

1. Leave a whole-of-life cover payout to settle an Inheritance Tax charge

Whole-of-life cover could be a highly effective way to help your family manage an IHT bill. This form of life cover guarantees a payout whenever you die, as long as you keep up with the premiums.

So long as the cover is written in trust, the payout will fall outside of the value of your estate for IHT purposes. As a result, when you pass away and your loved ones receive the payment, they could use this to pay off an IHT bill.

While this wouldn’t reduce the IHT payable, it would ensure that the tax would not be settled using assets you’ve left to your beneficiaries, effectively meaning you could leave more to your loved ones.

Above all, if you’re unsure of how this works, speak to us.

Using life assurance could also reduce the time it takes for your beneficiaries to receive their inheritance. Indeed, money from your estate typically can’t be released until the IHT liability is settled, which can take some time if they need to sell assets to raise the capital.

Since protection generally pays out within weeks of your passing, your beneficiaries could receive their inheritance far quicker, allowing them to settle an IHT bill and access the value of what you’ve left behind for them.

If you’re concerned about the cost of cover, it’s important to note that it may be lower than you expected.

This is because it might be structured as a “joint life, second death” policy, meaning that the payout typically happens after both in the couple have passed away.

Since the protection provider is covering both you and your partner’s lives and only pays out after the second death, the premiums tend to be lower than they would for separate policies.

2. Make the most of gifting allowances and exemptions

Since pensions are set to be subject to IHT in the future, giving gifts during your lifetime may have become even more important.

Not only can gifting wealth allow you to directly support your loved ones, but it also reduces the total value of your estate.

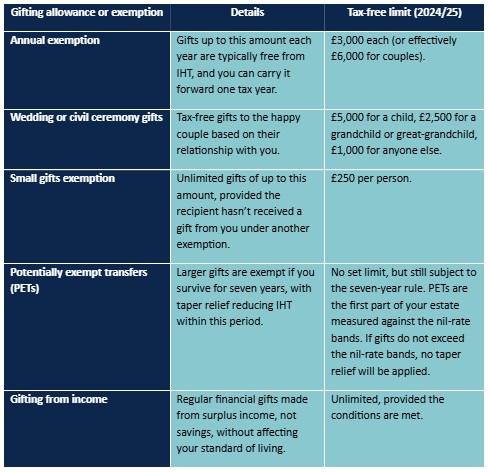

There are several allowances and exemptions for tax-free gifting, which the table below illustrates.

Ultimately, making the most of these gifting allowances and exemptions could help you reduce the size of your taxable estate, potentially mitigating the risk that your beneficiaries will face a considerable IHT bill.

If you are considering this strategy, it’s worth considering where you place these financial gifts.

For example, starting a junior self-invested personal pension (SIPP) or a stakeholder pension for your child or grandchild could help them secure their financial future very early on, all while reducing the value of your estate.

Assuming that your child or grandchild has no relevant earnings, you can contribute £2,880 each year to their pension as part of their Annual Allowance.

Then, for every £1 you invest, the government adds 25p in tax relief, bringing the total maximum annual contribution to £3,600 as of 2024/25. Over time, the power of compounding returns could mean that, by the time your child or grandchild retires, their pot could have grown significantly.

Similarly, gifting wealth to a Junior ISA (JISA) could provide a nest egg for a loved one, all while offering them invaluable lessons about managing their wealth, which our new article covers in great detail.

3. Consider using trusts

Aside from writing life cover into one, trusts could also be helpful for estate planning and protecting your wealth from IHT in other ways.

When you place money or assets in trust, it involves “locking away” a portion of your wealth for an intended recipient – known as your “beneficiary” – until a time of your choosing.

Doing so can ringfence a portion of your wealth, all while offering a tax-efficient planning alternative, as IHT for the assets held in some types of trust can be calculated in different ways, potentially saving your loved ones on a tax charge.

Bear in mind that trust planning can be complex. It can be sensible to seek professional guidance to help you if you’re interested in using trusts.

Why professional advice is essential

As you can see, estate planning can be complex, especially in light of changing financial legislation.

Gifting too much during your lifetime could inadvertently affect your standard of living, while setting up trusts or life assurance policies usually requires careful planning to ensure they suit your specific needs.

This is why it’s wise to work closely with a financial planner.

We can help create a tailored plan to mitigate your IHT liability, all while ensuring that your loved ones can benefit as much as possible from your legacy.

What’s more, we’ll make sure that if you do write whole-of-life cover into a trust, it’s the most appropriate protection for your circumstances.

To find out how we can support you, please use our search function to find your nearest Verso office, email us at contact@versowm.com, or call 020 7380 3300.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation, and regulation, which are subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.