It’s fair to say that earning a six-figure salary is undoubtedly an achievement. It shows just how hard you’ve worked over your career and places you in a strong position to build significant wealth for the future.

Though, as your income grows, so too can the challenges, particularly when it comes to taxation.

One of the more notable complexities for higher earners in the UK is the 60% Income Tax “trap”.

Recent reports show just how prevalent this issue is. Indeed, interactive investor reveals that the aforementioned tax trap affected 23% more people in the 12 months leading to July 2024 – roughly 537,000 individuals.

This quirk in the UK’s taxation system could prove costly if you don’t keep it in mind. So, continue reading to understand how the Income Tax trap works, and discover some ways to potentially mitigate its effects.

The Income Tax trap is a result of the tapering of your Personal Allowance

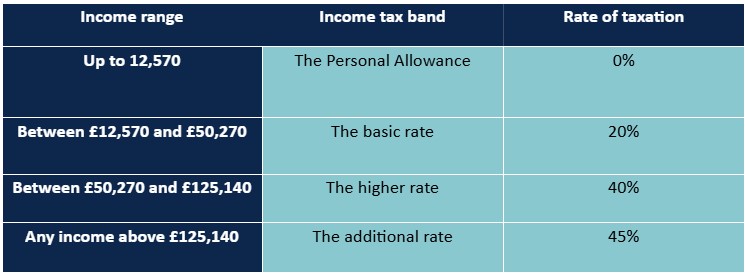

The UK’s Income Tax rates are designed to be progressive, as you contribute more as you earn more. In 2024/25, the Income Tax brackets are:

However, not included in this table is a key fact: once you earn more than £100,000, your tax-free Personal Allowance is tapered. This means that for every £2 you earn above £100,000, you lose £1 of your Personal Allowance, and this is what causes the 60% tax trap.

Once your adjusted net income reaches £125,140, your entire Personal Allowance is gone, and all your earnings are fully taxable.

This tapering essentially creates an effective tax rate of 60% on income between £100,000 and £125,140.

For instance, imagine your annual income is £110,000 – £10,000 above the £100,000 threshold. Since you lose £1 of your Personal Allowance for every £2 earned over the threshold, your Personal Allowance is reduced by £5,000.

That £5,000 is now subject to 40% tax, costing you £2,000. Moreover, you pay 40% tax on the £10,000 above £100,000, which amounts to £4,000.

In total, you pay £6,000 in Income Tax on the £10,000 of this portion of your wealth, leaving you with just £4,000 – an effective tax rate of 60% before any National Insurance deductions.

There are some ways to mitigate your Income Tax liability

While the 60% tax trap might be a significant challenge, there are some practical steps you can take to manage your Income Tax liability – read on to find out how.

Increase contributions to your pension

A practical way to lower your adjusted net income is by increasing your pension contributions. When you add money to your pension, these contributions are typically deducted from your income before tax, reducing the amount subject to taxation.

Returning to the earlier example, if you earn £110,000 each year, you will ordinarily face the 60% effective rate of taxation on the £10,000 above the threshold.

Though, if you contributed that £10,000 to your pension, you may be able to retain your full Personal Allowance while also benefiting from tax relief on your contributions.

Not only could this strategy reduce your tax liability, but also boost your pension savings, helping you secure your financial future.

Just note that if you’re a higher- or additional-rate taxpayer, you’ll need to claim any extra tax relief through your self-assessment tax return.

Consider salary sacrifice

Salary sacrifice is a government-backed initiative that allows you to exchange a portion of your salary for non-cash benefits, such as:

- Pension contributions and advice

- Financial protection

- Employer-provided childcare.

By reducing your overall salary through salary sacrifice, you could also lower your taxable income and potentially avoid the 60% trap.

For instance, if your employer allows you to exchange £10,000 of your salary for pension contributions, your adjusted net income would fall below the £100,000 threshold.

Better yet, this approach is fully tax-relievable, meaning the amount you would have paid in tax is instead added to your pension pot, further boosting your retirement savings.

Perhaps one of the more apparent benefits of salary sacrifice is its flexibility. Indeed, you could tailor the arrangement to suit your specific financial goals, whether that’s increasing pension contributions or accessing additional benefits.

Just note that you typically need to discuss any salary sacrifice options with your employer before it can come into effect.

Speak to a professional

As you can see, dealing with taxes in the UK can get complicated, especially as your income increases.

Thankfully, working with a financial planner could help you better understand your tax position and find bespoke strategies to mitigate the 60% tax trap.

A financial planner can review your earnings, recommend the most tax-efficient ways to allocate your income, and create a comprehensive plan that aligns with your long-term goals.

They’ll also ensure that you’re taking full advantage of the available tax reliefs and government schemes available to you, giving you greater clarity and confidence in managing your wealth.

Ultimately, working closely with a planner could mean you gain a clearer understanding of your options and ensure that the 60% tax trap doesn’t affect your hard-earned income.

To find out how we can support you, please use our search function to find your nearest Verso office, email us at contact@versowm.com, or call 020 7380 3300.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation, and regulation, which are subject to change in the future.